What Triggered the UK Energy Market Crisis and What is the Impact on BI Claims?

23 September, 2021

-

Katharina Wilson, Lee Swain

-

EMEA

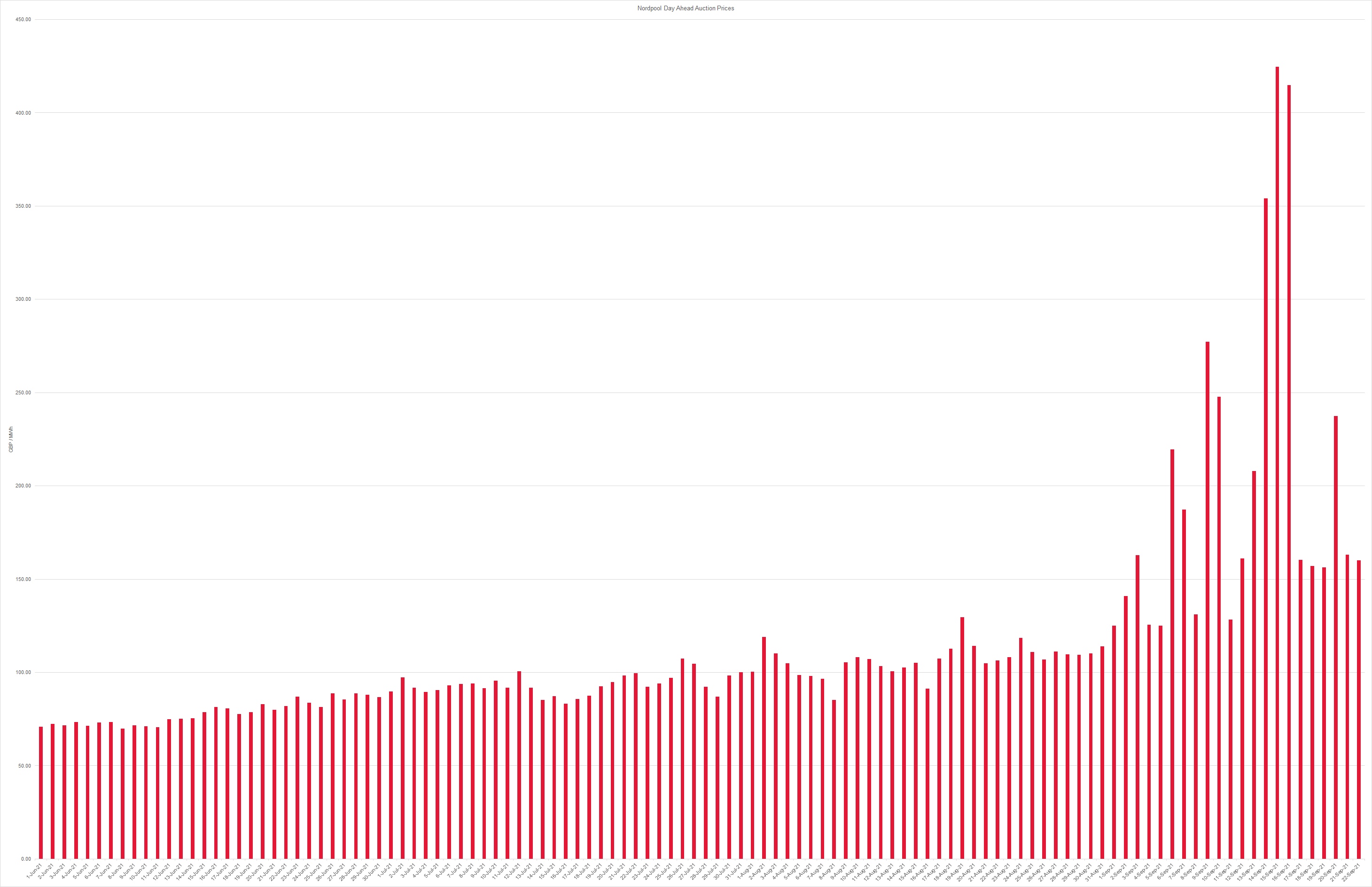

The UK’s energy wholesale markets have reached new highs, with daily average electricity prices rising above GBP 150 per MWh since early September 2021. A record high of GBP 424 per MWh, since at least January 2019, was reached on 15th September 2021 when a fire shut down the interconnector cable used for importing electricity from France to the UK.

Nordpool Day Ahead Auction Prices

The fire exacerbated the effects of soaring gas prices during a global surge in gas demand following a low-wind season and a cold winter in the UK, Europe, and Asia and increased post-lockdown energy demand. More than half of the UK’s electricity is produced in gas-fired power plants. High natural gas costs not only squeeze the margins of electricity generators but also increase prices for the food industry which relies on CO2 within their production processes. In the UK, CO2 is mainly sourced as a by-product of the fertiliser industry, where gas is the highest input cost. Soaring natural gas prices forced some fertiliser plants to shut in recent weeks, leading to a shortage of CO2 with a knock-on effect on beverage manufacturers and the livestock industry, which uses CO2 to stun livestock before slaughter. A combination of these factors results in a gloomy outlook for the UK winter and festive seasons ahead, affecting customer behaviour, spending patterns and business trend prognoses.

The effects of this crisis on future business interruption claims require a detailed analysis considering various factors, such as changing margins adopted for reserve purposes and idle periods that would need to be factored into loss calculations. The use of historical data and standard prognoses cannot be relied upon, requiring a team of trained expert accountants with the ability to recognise multiple market and price drivers in a global context.

MDD has the expertise needed to address these issues. Contact us to discuss this ever-developing issue in energy claims.

The statements or comments contained within this article are based on the author’s own knowledge and experience and do not necessarily represent those of the firm, other partners, our clients, or other business partners.

Authors

Industries

Articles

Relevant Articles

Our experts are extremely knowledgeable about thier subject areas and often write educational material and commentary on topical issues they come across.

How is Electrification Disrupting the Energy Sector?

One of the biggest trends shaping society today is the widespread adoption of Electric Vehicles (EVs). While Tesla pioneered this movement as a disruptor, nearly every automobile manufacturer worldwide is now actively developing its own electric vehicles. Governments have implemented...

Carbon Capture – Is it Really Going to Materialise?

Before we discuss the carbon capture process and how it is used, it is worthwhile conceptualising the carbon emissions emitted worldwide and why different technologies, including carbon capture, must be considered as part of the energy transition. As can be...

Natural Gas – The Past, Present and Future

There has been a significant push towards transitioning to cleaner and renewable energy sources, moving away from fossil fuels due to their environmental impact. By looking at the past, the present and the future, the question remains: can we realistically...

Renewable Energy Losses – Winds of Change

It is May 20, 1899. New York City taxicab driver Jacob German is the recipient of the United States’ first-ever speeding ticket. He whizzed by at 12 miles per hour on Lexington Avenue and was then pursued and remanded by...

Biomass (Co-Generation) Losses

Certain agricultural entities can generate energy from the organic matter derived from their production process. This type of co-generation of energy is referred to as biomass energy. These biomasses can be agricultural in nature, as in the case of sugarcane...

The Effect of Volatility on Power Generation Business Interruption Losses

It is clear to the casual observer that many aspects of the economy are facing volatility. Fuel, energy, labor, shipping - all have experienced unprecedented shortages and price increases because of a myriad of conditions. The Russia-Ukraine war, Covid-19, inflation,...

Upstream Oil and Gas Losses

In this briefing, we discuss various considerations in upstream oil and gas production losses, and in particular how rates of production depend on the type of well. We also discuss what the shift to horizontal drilling and hydraulic fracturing means...

How is the Power Generation Landscape In Canada Evolving and What Are The Challenges It Faces in the Near Future?

Canada is a world leader in power generation as it pertains to sources that do not emit greenhouse gasses. At the current moment, 83% of generation comes from non-emitting sources. Canada’s goal by 2030 is to have 90% of power...

Waste to Energy

What is Waste to Energy? Waste to energy refers to the process of converting municipal solid waste (MSW), otherwise known as trash, into usable heat, electricity, or fuel. The three main MSW categories include: Biomass or biogenic (plant or animal...

An Introduction to Natural Gas: Separation, LNG and GTL Plants

Our first technical briefing introduced the Oil & Gas value chain, divided into: i) upstream; ii) midstream; and iii) downstream. Here is a recap, before we explore natural gas in more detail. Upstream: this involves the exploration and extraction of...

Imbalance of Gas Supply

The sanctions imposed on Russia amid the Russia-Ukraine conflict have impacted global gas markets, particularly those in Europe. Russia is the second largest producer of natural gas globally and used to supply about 40% of Europe's natural gas. However, supplies...

Renewable Energy Certificates

Since 1978, American regulators and policymakers have looked to incentivize the investment and development of generating renewable energy. Individual states began enacting Renewable Portfolio Standards (RPS) to support this mission by requiring a specific percentage of a utility’s energy portfolio...

Potential Quantification Issues for Losses Involving Wind Farms Under Construction

Quantifying the financial impact stemming from the failure of an already commissioned single stand-alone wind turbine generator presents challenges, but these challenges increase exponentially when the failure occurs at a wind farm under construction. Additional complexities surface to the extent...

The Global Energy Crisis

As the Ukrainian conflict unfolds, Europe’s energy dependence on Russia becomes an increasingly critical bargaining tool. The economic sanctions imposed by some Western nations in response to Russia’s invasion appear to be increasingly directed against Russian oil and gas supplies...

Measuring Refining Margins for a BI Loss

When it comes to Business Interruption policies for Oil & Gas risks, there are different types of coverage available in the market, including Gross Profit, Gross Earnings, Specified Standing Charges etc. Common Policy Wordings Gross Profit equates to Turnover less...

The Importance of Linear Programs (LPs) in Refinery Claims

The use of Linear Program models is common in refining, and other industries, to optimise their activities by using an algorithm subject to a set of inputs, constraints, and relationships. This article discusses the LP models in more detail and...

What Happened to Jet Fuel During Covid-19?

The main types of jet fuels used by airlines are Jet A-1, Jet A and Jet B. Jet A is mainly used in the United States, whereas Jet A-1 is commonly used outside the United States and Jet B is...

A Lightning Fast Intro to Energy Market Basics

The summer has come to an end in Florida. Temperatures are still hot, and the afternoon thunderstorms are raging. So, when I open my electricity bill and gasp at the month’s cost, muttering some hopeless comments about how I should...

The Recovery of Oil & Gas: A Roller Coaster Ride or Merely a Few Speed Bumps?

Covid-19 has led to major disruptions across various sectors and the petroleum industry is no exception. Demand for oil and petroleum products, in general, declined due to reduced economic activity as governments worldwide imposed lockdowns and tightened border controls. Certain...

What Triggered the UK Energy Market Crisis and What is the Impact on BI Claims?

The UK’s energy wholesale markets have reached new highs, with daily average electricity prices rising above GBP 150 per MWh since early September 2021. A record high of GBP 424 per MWh, since at least January 2019, was reached on...

Introduction to the Oil & Gas Value Chain

The Oil and Gas industry in the insurance market is usually categorised between Onshore/Offshore or Upstream/Downstream. It includes a chain of businesses relating to extraction, transportation, refining, petrochemical and chemical – essentially from the carbon in the ground to the...

Regulated and Deregulated Electricity Markets: What is the difference when modelling power generation losses?

Introduction When modelling power generation losses for Business Interruption (“BI”) or Delay in Start-Up (“DSU”) purposes, it is important to understand the type of market(s) the Insured participates in and specifically how it operates within those markets. In this introductory...

The Effect of Deductibles & Policy Wording – Is It What You Think?

With a typical Energy claim standing at approximately USD 4.5 million, it’s no surprise that Business Interruption (BI) is once again the #1 business risk for the fourth year in a row[i]. To help insurers mitigate their exposure when an...

Court Breaks with Apportionment

The case of Varco Canada Limited v. Pason Systems Corp., 2013 FC 750 (CanLII) involved an award of over $52M based on an accounting of the defendant’s profits. Perhaps more importantly, the decision sheds light on a number of conceptual...